hotel tax calculator texas

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. 1 State lodging tax rate raised to 50 in mountain lakes area.

Two rate hikes by lawmakers in the.

. Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. NA tax not levied on accommodations. The calculator will show you the total sales tax amount as well as the county city and.

So if the room costs 169. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. The State of Texas imposes an additional Hotel Occupancy Tax.

Maximum Local Sales Tax. That means that your net pay will be 45925 per year or 3827 per month. The City of Austins Hotel Occupancy Tax rate is 11 percent comprised of a 9 percent occupancy tax and an additional 2 percent venue project tax.

Maximum Possible Sales Tax. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it.

Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Texas Income Tax Calculator 2021. Your average tax rate is 1198 and your marginal tax rate is. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

No additional local tax on accommodations. Cities and certain counties and special purpose districts are authorized to impose an additional local. The states HOT tax as its often called has been around since 1959 when the Texas Legislature enacted a 3 percent hotel occupancy tax.

Your household income location filing status and number of personal. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

To report and pay your taxes you must log. A state employee is not exempt from paying a state. Only In Your State.

Texas law requires that each bill. Our online application process is simple. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

This tool is provided to estimate past present or future taxes. Average Local State Sales Tax. This is not an official tax report.

Texas State Sales Tax. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. The Texas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

And if you live in a state with an income tax but you work in Texas. A state employee is entitled to be reimbursed for hotel occupancy taxes incurred while traveling on state business. Hotel and Short Term Rental Tax Calculator.

Tax Rates Stripe Documentation

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

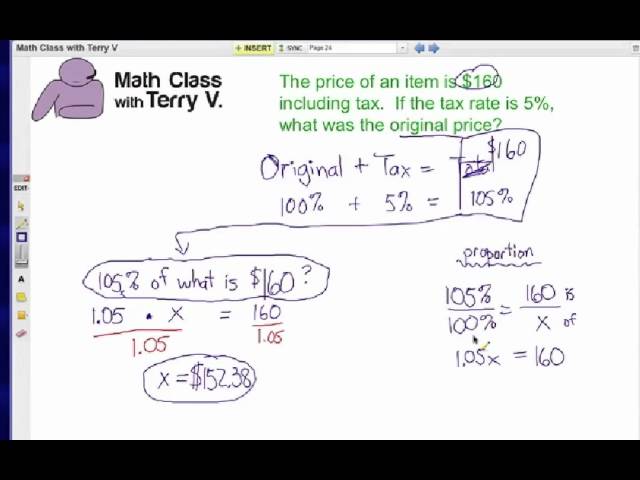

How To Find Original Price Tax 1 Youtube

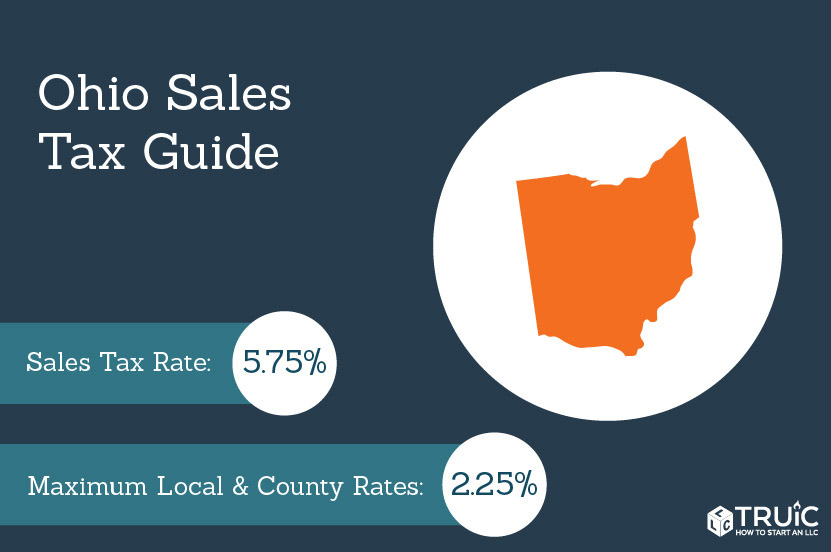

Ohio Sales Tax Small Business Guide Truic

Texas Sales Tax Calculator Reverse Sales Dremployee

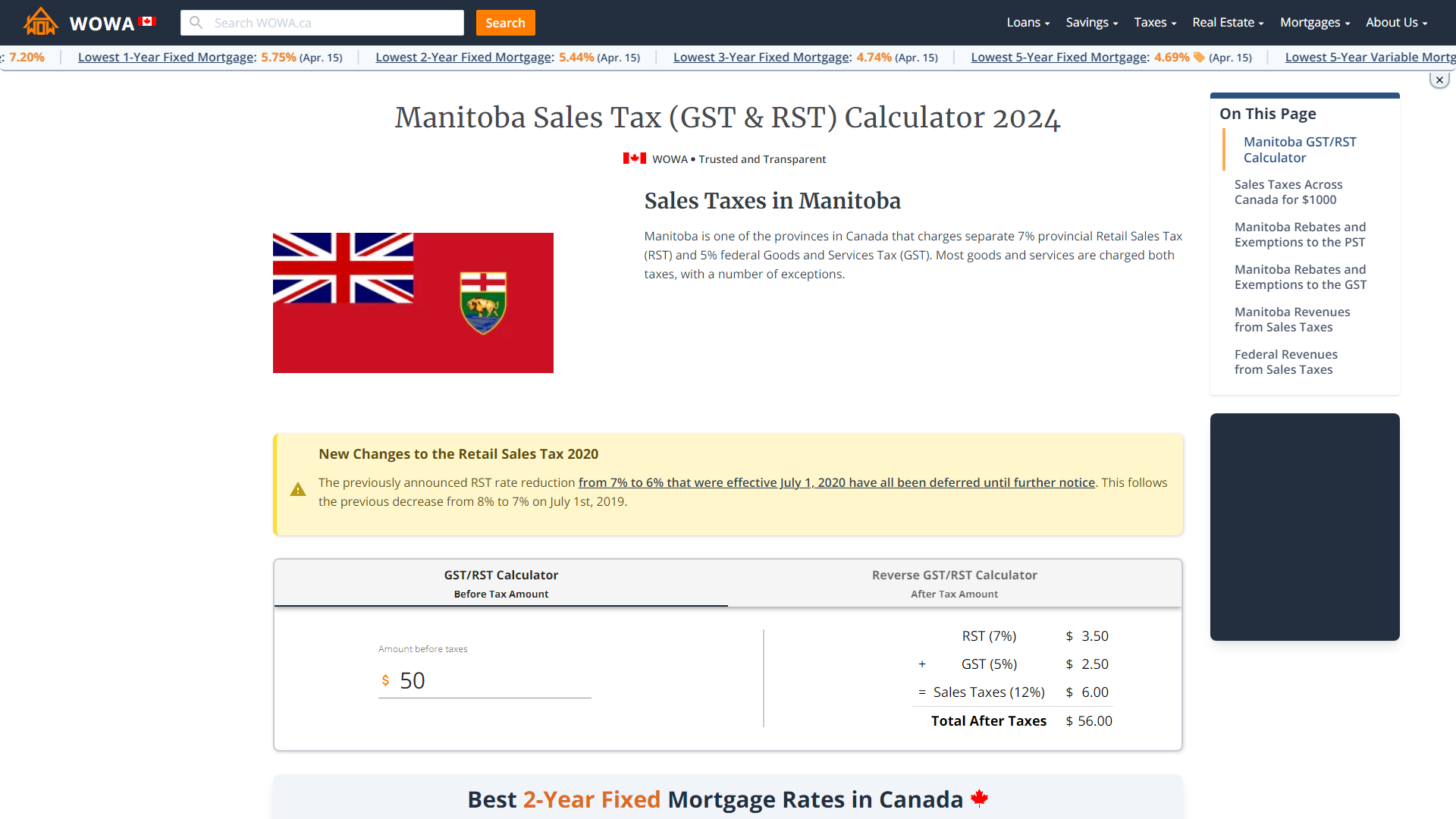

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

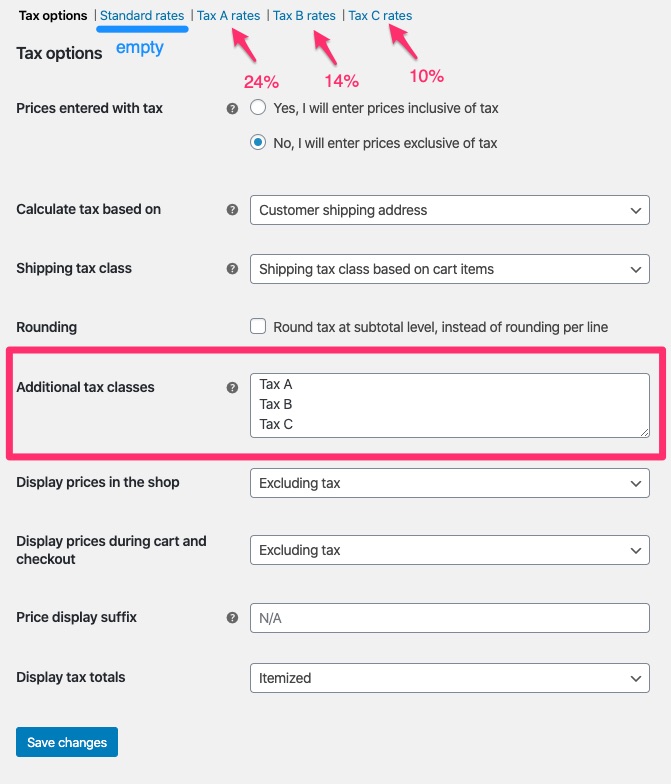

Setting Up Taxes In Woocommerce Woocommerce

Enterprise Tax Compliance Software

288 208 Calculator Photos Free Royalty Free Stock Photos From Dreamstime

10 Creative But Legal Tax Deductions Howstuffworks

Texas Income Tax Calculator Smartasset

Hotel Invoice Sample Guest Bill Guest Folio Template Hotels Resorts

May 2022 Roundup Tax Laws You Need To Know

New York Property Tax Calculator 2020 Empire Center For Public Policy