maine car tax calculator

If you buy cigarettes in Maine youll have to pay the states cigarette tax. Simply enter the loan amount term length and interest rate above and the Maine car loan calculator with extra payments will calculate your monthly car loan payments.

Welcome To The City Of Bangor Maine Excise Tax Calculator

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle.

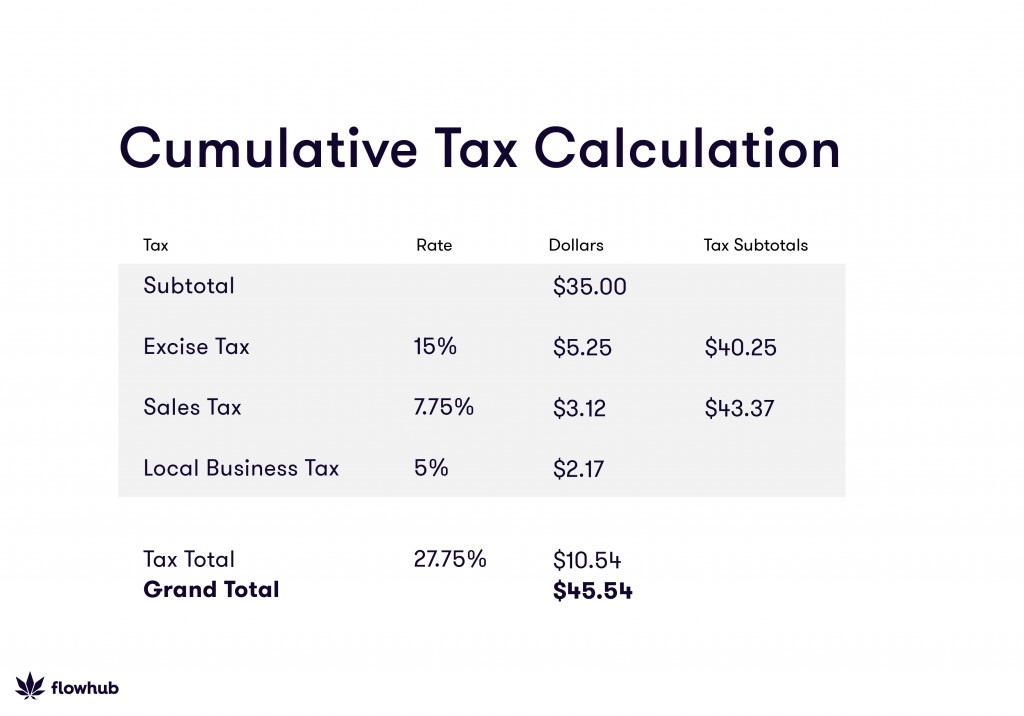

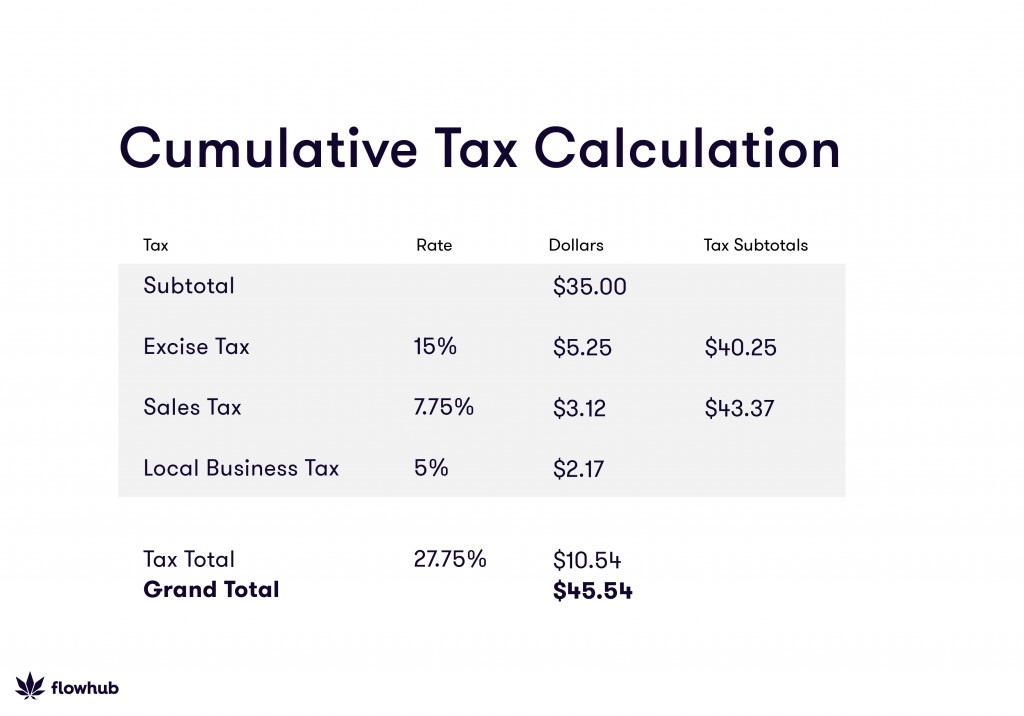

Maine calculates this tax by taking the current MSRP of your vehicle and multiplying it by the mileage rate. How to Calculate Maine Sales Tax on a Car. Excise Tax is an annual tax that must be paid prior to registering a vehicle.

To calculate the excise on your vehicle the following scale is used. Please note this is only for estimation purposes -- the exact cost will be determined by the city when you register your vehicle. How much will it cost to renew my registration.

After a few seconds you will be provided with a full breakdown of the tax you are paying. This calculator is for the renewal registrations of passenger vehicles only. Average DMV fees in Maine on a new-car purchase add up to 35 1 which includes the title registration and plate fees shown above.

Find your state below to determine the total cost of your new car including the car tax. This means that the applicable sales tax rate is the same no matter where you are in Maine. Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen.

It adds up to 200 per pack. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Excise tax is an annual tax that must be paid prior to registering your vehicle.

To calculate your estimated registration renewal cost you will need the following information. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Car tax as listed. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Maine Documentation Fees.

For example if your vehicle has an MSRP of 8950 and a milage rate of 0065 you will. These fees are separate from. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Your employer withholds money to cover your Maine tax liability just like it. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid. Dealership employees are more in tune to tax rates than most government officials.

After 0004 Year one is the current model year 2020 year 2 is 2019 etc. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. Vehicle tax or sales tax is based on the vehicles net purchase price.

The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. IT IS DIFFICULT TO QUOTE EXCISE TAX FIGURES OVER THE TELEPHONE BECAUSE WE NEED TO SEE THE APPROPRIATE PAPERWORK TO DETERMINE THE CORRECT EXCISE TAX.

Year 1 0024 Year 2 00175 Year 3 00135 Year 4 0010 Year 5 00065 Year 6. Once you have the tax. For example if you purchase a new vehicle in Maine for 40000 then you will have to pay 550 of the purchase price as the state sales tax or 2200.

It is NOT necessarily what you paid for the vehicle. 775 for vehicle over 50000. Like all states Maine sets its own excise tax.

Maine Car Loan Calculator. Its fairly simple to calculate provided you know your regions sales tax. Maine residents that own a vehicle must pay an excise tax for every year of ownership.

If you are unsure call any local car dealership and ask for the tax rate. This is the sticker price of the vehicle and its accessories. The MSRP is the Manufacturers Suggested Retail Price of your vehicle.

Vehicle Tax Costs. Payment of an excise tax is required on all vehicles in the town of residence before registration. This calculator is for the renewal registrations of passenger vehicles only.

Maine is an alcoholic beverage control state meaning the states Bureau of Alcoholic Beverages and Lottery Operations controls the wholesale of liquor and fortified wines within the state. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. For single filers the first bracket of up to 22000 comes with a tax rate of 580 while the second bracket income between 22000 and 52600 is taxed at a rate of 675 and the top bracket income of 52600 and up is taxed at the states top rate of 715.

Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper. Monday-Friday 8AM to 5PM.

Enter your vehicle cost. The excise tax due will be 61080. 1 City Hall Plaza Ellsworth ME 04605.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. The motor vehicle excise tax is based on the manufacturers suggested retail price when the vehicle was new as taken from the window sticker. WHAT IS EXCISE TAX.

Please use the excise tax calculator. 425 Motor Vehicle Document Fee. 635 for vehicle 50k or less.

Feel free to use our handy excise tax table. The MSRP is the sticker price and NOT necessarily what you paid for the vehicle. Excise Tax is an annual tax that must be paid prior to registering your vehicleExcept for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject to the Excise TaxExcise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle boat or camper trailer on the public ways.

You can also enter additional fields such as the trade-in value of an existing car or the down payment if you are financing the car. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Contact 207283-3303 with any questions regarding the excise tax calculator.

Maine Car Registration A Helpful Illustrative Guide

Maine Vehicle Sales Tax Fees Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Car Tax By State Usa Manual Car Sales Tax Calculator

Welcome To The City Of Bangor Maine Excise Tax Calculator

Maine Vehicle Sales Tax Fees Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Car Loan Calculator Maine Dealer Consumer Calculator

How To Calculate Cannabis Taxes At Your Dispensary

Maine Car Registration A Helpful Illustrative Guide

Maine Vehicle Sales Tax Fees Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Welcome To The City Of Bangor Maine Excise Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator